Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur eleifend tortor nec augue pretium

Sustainable finance incorporates environmental, social and governance (ESG) considerations into financial decision-making to address global challenges.

Valued at $5.49trn in 2023, the sustainable finance market is projected to grow to $38.19trn by 2034.

Sustainable finance initiatives include ESG-focused asset investment and management, social impact investing, green investments/bonds and sustainable banking.

Towards decarbonisation

Sustainable finance market growth is dominated by European organisations such as the European Investment Bank (EIB), contributing €44.3bn in 2023 towards sustainability and climate action. The EIB’s >€1 trillion for <1.5°C paper outlines its goals for sustainable finance investments, including its new energy lending policy to support decarbonisation of the energy supply.

Sustainable finance also encourages the construction of energy-efficient buildings through financing green building certifications. BREEAM Certification Schemes have an 80% market share in Europe and align with the EU taxonomy for sustainable practices. This establishes greater compliance and standardisation, and provides sustainable finance opportunities for BREEAM-assessed buildings, as explored in BRE’s 2022 A Guide to the EU Taxonomy and BREEAM.

Additionally, the UK government’s Green Heat Network Fund (GHNF), a £288m grant, provides funding towards decarbonising the heat network.

Exeter Energy Network received £42.5m towards building a low- to zero-carbon heat network using air-source heat pumps and a high-temperature water-source heat pump. Connecting homes and buildings to this network is expected to reduce CO2 emissions by 65-75% compared with gas heating, according to Exeter City Council. By directing sustainable finance to energy-efficiency schemes, the GHNF contributes to the UK’s goal of achieving net-zero emissions by 2050.

Investing responsibly

A major driver for sustainable finance is ESG-related asset management and impact investing. Aviva Investors, a global asset manager, surpassed its target to finance £1bn in sustainable real estate after extending a £227m ESG and sustainability loan to investment firm Romulus. The loan’s favourable borrowing rates are contingent on meeting sustainability-related KPIs and evidencing measurable sustainability improvements in lent assets.

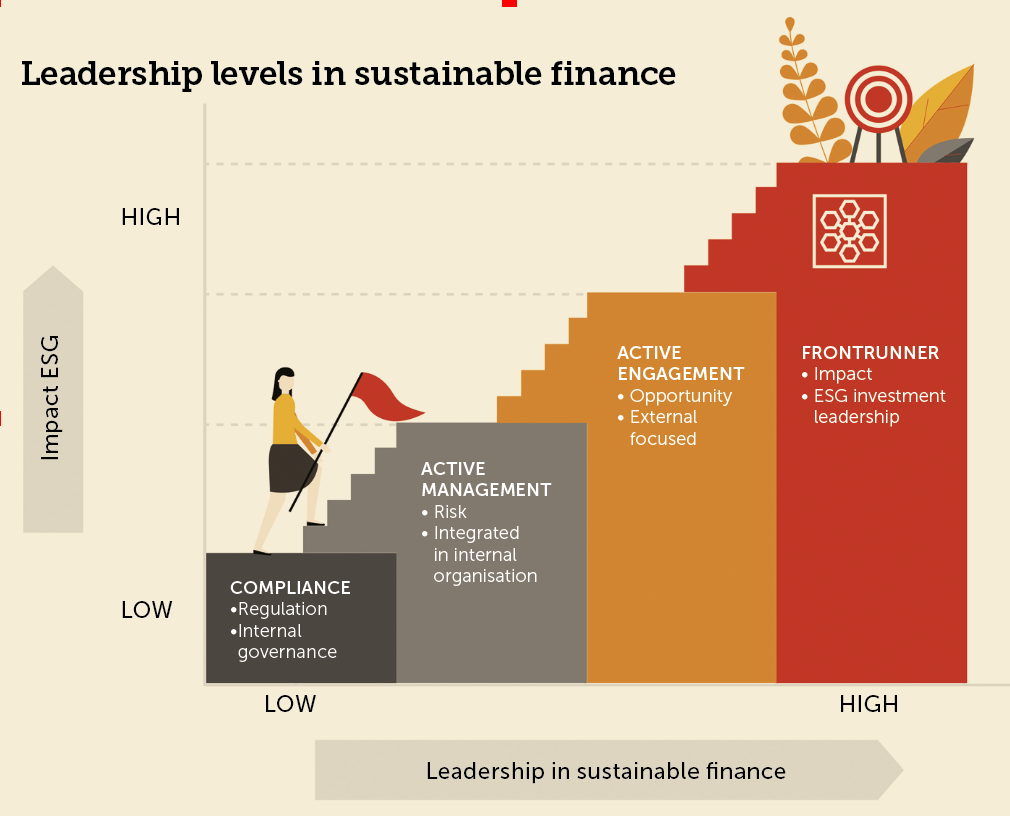

Asset managers aim to create ESG policies and targets to improve the profile of their investments, to consider long-term risks, and to report on ESG performance. They face key challenges in ESG reporting, including lack of standardisation in reporting methodologies and insufficient transparency in ESG data and policies.

In a 2021 survey of 300 US and European asset managers, titled Measurable Impact: Asset Managers on the Challenges and Opportunities of ESG Investment, 64% of them reported insufficient transparency and disclosure in ESG activities. This limits the extent to which they can evaluate their fund’s ESG-related performance, assess risks and precisely direct sustainable finance investment.

To meet growing investor demand, fund managers are increasingly reporting on their ESG via benchmarks such as GRESB, which commit to transparent reporting and third-party verification.

Realising the immense potential of sustainable finance to drive the transition to a sustainable built environment requires greater standardisation of regulations, more effective funding allocation and enhanced transparency in ESG reporting.

Anjali Khanna is a junior sustainability consultant at Envision