Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur eleifend tortor nec augue pretium

Brazil’s renewable energy installed capacity is already notably high compared to other nations. In 2023, approximately 85% of the generated energy originated from renewable sources, representing approximately 200 GW.

In particular, the solar photovoltaic (PV) sector has experienced rapid growth in recent years, demonstrating Brazil's commitment to decarbonisation and to the ongoing expansion of its renewable energy infrastructure.

This growth is largely driven by national renewable energy investment programs, regulatory incentives including net metering policies that ease the integration of small-scale generators into the national grid.

These measures promote energy independence and resilience. Additionally, the global decline in PV equipment prices and the broader shift towards renewable energy have further accelerated the expansion of Brazil's solar industry.

The diagram to the left shows the percentage of each energy source that makes up the total electricity matrix in Brazil.

Nevertheless, the PV sector faces challenges within a sustainable framework. There is reliance on imported solar panels and materials, which has led to the increase in import taxes aimed at encouraging domestic production.

While these measures have raised concerns about the potential impact on market growth and affordability, they may also stimulate future investments in local PV manufacturing capabilities, currently limited.

Another concern is the management of end-of-life (EoL) solar panels. The development of a waste management infrastructure for PV panels is important.

In addition, the sector requires legislative clarity with regards to producer responsibility obligations and the inclusion of mandatory reverse logistic systems for EoL PV modules.

Overall, Brazil's PV sector is experiencing significant growth due to strategic policies and economic trends.

However, to align this expansion to circular economy goals, it is crucial to establish a specific reverse logistic system and enhance local production capacity. These steps will ensure a sustainable growth for the sector.

The growth of PV solar energy

According to the International Renewable Energy Agency IRENA (2024), around 346 GW of solar PV capacity was added to the world’s renewable energy mix in 2023, 74% more than the 199 GW added in 2022.

In line with global trends, Brazil's PV sector has experienced significant growth in recent years, particularly through small and medium rooftop solar installations (distributed generation). In the first quarter of 2024, the PV sector led the expansion of installed capacity of renewable energy sources in Brazil (ANEEL).

Prevalence of distributed generation

Unlike centralised generation, where power plants produce electricity and transmit it over long distances to customers, distributed generation occurs near the point of use, such as with solar panels on the rooftops of residential and commercial buildings. In Brazil, solar power is currently used in 99.9% of all distributed generation connections in the country, the remaining comprises of small hydroelectric and wind energy. Over 99% of those installed PV systems in distributed generation are micro and mini generation systems (those with up to 5MW capacity).

PV installed capacity

By March 2024, more than 2.6 million photovoltaic (PV) systems were connected to the grid, with a total installed capacity exceeding 41 GW. Of this, approximately 28 GW were from distributed generation systems (up to 5 MW), and just under 13 GW from centralised generation sources. It was estimated that the installed PV generation capacity could reach 46 GW by the end of 2024, representing a growth of over 50% compared to the previous year (Absolar/ ANEEL).

The figure below summarises the sector’s development up to March 2024. It highlights the dominance of distributed generation systems over large centralised systems and the steady growth of the PV sector specially over the last five years.

The PV distributed generation capacity is concentrated across four States (out of 32). All located in the South and Southeast regions of the country (the wealthiest and most populated regions): São Paulo, Minas Gerais, Rio Grande do Sul, and Paraná, together making up approximately 14GW or almost half of the total distributed generation capacity in Brazil (ANEEL, 2024).

The National Interconnected System (SIN) is the Brazilian National Grid, it is considered one of the largest electricity transmission systems in the world. According to the National Electric System Operator (ONS), the SIN has an installed capacity of over 220 GW and covers approximately 180,000 km. Of the grid capacity, approximately 50% is used by hydro power transmission and approximately 20% is used for PV power transmission. (ONS, 2024).

The grid capacity continues to expand to reinforce links between South/ Southeast regions with Northeast/ North regions.

Recently, the Brazilian Ministry of Mines and Energy (MME) has announced a proposal to build 15,000 km additional transmission lines by 2032.

Key national policies, regulations and incentives

Some policies and regulations regarding solar PV energy in Brazil are in place and have been amended over the years to adapt to trends and needs of the national solar energy sector, aiming to incentivise its development towards a sustainable growth.

In 2012, Brazil's solar energy generation capacity was minimal (note figure 2 above). The introduction of net metering policy by ANEEL that year marked the beginning of the growth in the PV sector. This policy incentivised investment and development in renewable energy.

ANEEL's Net Metering policy allowed small generators using solar, hydro, biomass, wind, and qualified cogeneration of renewable sources with capacities up to 1 MW to qualify for net metering. The maximum allowed capacity was up to 3 MW for small hydropower units and up to 5 MW for other qualified renewable sources, including solar. These qualified systems are allowed to sell surplus generated electricity back to Brazil’s national grid in return for billing credits.

Recently, Law No. 14,300/2022 introduced changes to ANEEL's policy, specifically affecting new PV installations. The law established gradual charges for surplus energy exported to the grid, applying to distributed generation systems up to 5 MW installed after January 2023. These charges, known as the Tariff for Use of the Distribution System (TUSD), are designed to cover the costs of grid services, including the maintenance and operation of the electrical grid infrastructure.

On the one hand, the introduction of the TUSD aims to create a more sustainable model for maintaining the electrical grid infrastructure. By ensuring PV systems contribute to grid maintenance, it finds a balance between incentivising renewable energy adoption and supporting the growth of distributed generation. This regulatory framework reassures investors facilitating long-term planning for solar projects.

On the other hand, some industry stakeholders have expressed concerns that the recent charges could make solar energy less financially attractive for new installations, potentially slowing adoption. In fact, since the law’s implementation, a slowdown in the installation of small residential systems has been noted. However, investment in the sector has remained robust, and with the global decline in PV equipment prices in 2023, the growth of the PV sector has picked up the pace and does not appear to have been significantly hindered.

The Free Energy Market system plays a vital role in Brazil's PV industry, enabling direct contracting between electricity suppliers and consumers. Managed by the Electric Energy Trading Chamber (CCEE), this system oversees the market and facilitates contract settlements between the parties.

Recently, the Ministry of Mines and Energy (MME) introduced favourable updates to the system. Previously, only PV systems with a minimum capacity of 500 kW could participate. However, as of January 2024, eligibility has been expanded to include units operating at a minimum voltage of 2.3 kV. This change significantly broadens access to the Free Energy Market, benefiting the distributed generation sector by encouraging greater adoption of solar PV systems and allowing smaller consumers to get into free market opportunities. This expansion is expected to drive further growth and investment in solar energy in Brazil.

The Special Tax Regime for Infrastructure Development (REIDI), also issued by the MME (through Regulation n. 78/GM/MME), established criteria for distributed generation projects to qualify for tax exemptions (PIS and COFINS, national taxes) for up to five years. This benefit applies not only to solar projects but also to wind and other renewable energy initiatives. The initiative aims to boost investment in renewable energy and accelerate Brazil's energy transition.

Global decline on prices of PV components and raw materials

Throughout recent years, solar panel prices plummeted in the international market, reaching a historic low of approximately US$ 0.10/W in May 2024, from approximately US$ 0.25/W in the end of 2022. This sharp decline was driven by a production capacity surplus of PV equipment, concentrated in China, which exceeded global demand. The price of polycrystalline silicon, the key raw material for PV cells, dropped by 51%. Lithium dropped significantly, by 82% in 2024 compared to the previous year. Greener anticipates these prices will remain at similar levels throughout 2024 (Greener Consultoria Ltda, March 2024).

As a result, the prices of PV systems, including installation, have significantly decreased in Brazil. By March 2024, the average cost of a residential 4 kWp PV system had fallen to R$13,000 (approximately £2,000), marking a 28% reduction since January 2023. Similarly, the average cost of a commercial 50 kWp PV system decreased by 34% during the same period, reaching R$122,500 (approximately £18,500) (Greener Consultoria Ltda, March 2024).

Reliance on imports

Brazil remains dependent on the import of PV system equipment. Although some businesses carry out the assembly of PV systems, they are still dependent on imported key materials such as silicon cells, glass, silver paste, and encapsulants. While there is some local production, it remains small and insufficient to meet the growing domestic demand; it is estimated that local production account less than 5% of the domestic needs.

Additionally, the local production cannot yet compete cost-wise with panels produced in China. Consequently, domestically produced equipment is typically used in projects financed by banks that require the use of local equipment (Portal Solar, 2024). In 2023, approximately 20 GW of solar panels were imported from China, an increase of 15% from previous year (Infolink Consulting).

PV panels and certain components were previously exempted from import tax. However, since January 2024, an import tax of over 10% was reinstated on PV panels. To allow the market time to adjust to this change, specific import exemption quotas for PV panels and certain components have been established in decreasing amounts until 2027.

This decision has sparked concerns within the PV industry. Some experts argue that the tax increase could jeopardise the growth of the PV sector in Brazil. On the other hand, others highlight the potential for investment in domestic manufacturing, which could foster the development of the national solar PV industry and reduce reliance on imports.

The MMA (Ministry of the Environment and Climate Change) has highlighted that Brazil is one of the world's leading exporters of metallurgical-grade silicon, a key raw material to produce solar PV panels. Transforming this metallurgical silicon into solar-grade silicon is necessary for PV panel production. According to experts, this conversion process is relatively straightforward and could be a significant benefit for the growth of the domestic PV manufacturing industry.

Despite the tax increase, recent studies confirmed that imports of PV modules already reached almost 11 GW in the first semester of 2024, with 70% of that destined to distributed generation systems (Greener Consultoria Ltda, August 2024).

Lifespan and premature EoL

IRENA estimates that more than 550,000 tonnes of PV modules will be discarded in Brazil over the next three decades. Although the typical operational lifespan of PV panels ranges from 25 to 30 years, it is a misconception to assume that all waste will only emerge after this period. In fact, estimates suggest that at least 7% (with some sources indicating as much as 14%) of panels sustain damage before reaching 15 years of use. Early damage is often caused during transportation, by installation errors, or external events like windstorms.

EoL recovery, challenges and benefits

Inappropriately disposing of PV panel waste can lead to several issues, including the potential leaching of hazardous chemical elements like lead and cadmium. Additionally, it results in the loss of critical raw materials such as silver, bauxite (aluminium), gallium, germanium, palladium, silicon, and copper.

Recovery of PV panel waste not only minimises residues and waste-related carbon emissions but also enables the recovery of valuable materials. A recovery process reduces the need for extracting more raw materials, thereby minimising the environmental impacts associated with extraction.

By recovering materials from PV panels, the industry aligns with circular economy principles by keeping materials in use for as long as possible at their highest possible value.

Critical raw materials require special handling and specific recycling methods. These elements are present in very low concentrations in PV systems, such as silver, tin, copper and silicon (compared to other materials such as glass), making their recovery challenging and uneconomical.

The diagram to the left shows the materials composition by weight encountered in a typical PV module.

EoL management

In 2021, the Brazilian company SunR – Reciclagem Fotovoltaica Ltda began operations as the first PV recycling company in Latin America. In August 2024, it announced a partnership with PV CYCLE, which shall boost SunR’s recycling capacity and operational efficiency and will allow it to provide international certification to its clients. With two operational facilities, both located in the Southeast region of Brazil, SunR is currently planning to expand with a new facility in the Northeast region.

Due to the early disposal of broken/ damaged panels, the demand for recycling provided by SunR had increased significantly over the past year. By August 2024 it had already received 2,800 tonnes of modules for recycling (approximately 91,000 modules), matching the total volume received over the previous four years combined. SunR estimates that this figure will reach 4,500 tonnes by the end of December 2024 (PV Magazine Brazil and SunR- Reciclagem Fotovoltaica Ltda).

SunR’s recycling process is entirely mechanical. Initially, the aluminium structure, copper wires, and electronic and connector components are removed. The panels are then crushed. The crushed materials undergo density and particle-size separations to detach glass and metals from each other. The output materials include aluminium, cabling, junction boxes, plastic, glass, and a mixed metal fraction of silicon, silver, copper, tin, and other metals. The mixed metal fraction is exported to qualified third parties who carry out chemical extraction processes to separate the individual metals (SunR- Reciclagem Fotovoltaica Ltda).

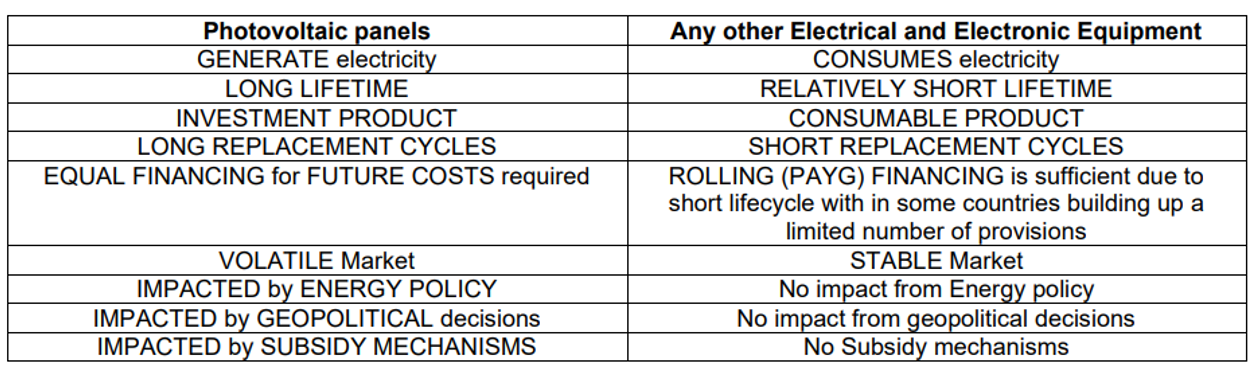

The National Solid Waste Policy (PNRS) 12.305/2010, the National Waste Management Regulation, includes PV equipment within the scope of Electrical and Electronic Equipment (EEE), imposing similar waste management obligations. In Brazil, waste management obligations align with the EU's producer responsibility principles. It encompasses a shared responsibility with emphasis on producers’ obligation for the implementation of reverse logistic systems for specific waste materials and/ or returned products, such as WEEE/ EEE.

However, fundamentally, PV modules do not fall within the concept of EEE, as detailed below:

By classifying PV modules as EEE, the PNRS has created uncertainty regarding producer obligations for managing broken or damaged PV equipment. This has led to non-compliance within the solar PV industry, and as a result, no specific reverse logistics system for PV equipment has been established. SunR has emphasised the urgent need for a specific reverse logistics system to collect and transport broken/ damaged PV modules for recycling.

In response, two Bills have been drafted and are currently under discussion. Bill n. 3784/2023 proposes the creation of a separate category under the PNRS specifically for PV solar panels. This Bill aims to clarify the obligations of producers (manufacturers, importers, distributors, and retailers) in the establishment of reverse logistics systems for PV equipment, addressing existing uncertainties.

The more recent Bill No. 998/2024 sets out guidelines for recycling PV panels. It aims to develop national infrastructure and standards for the recycling process and ensure appropriate waste management. Additionally, the Bill includes incentives to promote the reuse, refurbishment, remanufacturing and reuse of recyclable components and materials, further supporting sustainable practices in the solar industry.

Additionally, the National Policy for Circular Economy draft (n. 5723/2023) was approved by the Senate in August 2024 and will come into force soon. This policy is expected to significantly boost the waste management infrastructure and the reuse, refurbishment, and recovery of materials overall.

Conclusion

The PV solar energy sector in Brazil has grown steadily, particularly the distributed generation. This increase has been pushed by national regulatory incentives, significant declines in the prices of PV equipment, and strong global trends towards renewable energy. Distributed generation, primarily via rooftop solar installations, dominates Brazil's PV landscape, contributing significantly to the national electricity matrix and promoting energy independence at the local level.

Despite the significant advancements, the sector faces challenges, notably its reliance on imported solar panels and associated components. The recent increase in import taxes aims to stimulate domestic production, yet it raises concerns about potential impacts on market growth and affordability. While local manufacturing remains limited and unable to compete with international prices, the policy shift might drive future investments in Brazil's PV manufacturing capabilities.

Environmental considerations are critical due to the increasing number of PV installations which will inevitably lead to substantial EoL panel waste. Statutory clarity and the establishment of specific reverse logistic systems are essential to ensure sustainable waste management practices for the sector.

While Brazil's PV sector is on a steady growth path supported by strategic policies and economic trends, ongoing efforts to expand local PV modules manufacturing capacity, clarify waste management obligations and strengthen recycling infrastructure will be critical for ensuring the long-term success and sustainability of the solar energy industry in Brazil.

Stella Consonni is an independent environmental consultant

Diagram sources:

1) Infographic Report by Absolar - the National Association of Solar PV Energy, and ANEEL – the National Electric Energy Agency, 2023

2) Infographic Report, ABSOLAR / ANEEL, March 2024

3) Deng et al 2022

4) PV Cycle Position Paper, November 2023